[vc_row type="in_container" full_screen_row_position="middle" column_margin="default" scene_position="center" text_color="dark" text_align="left" overlay_strength="0.3" shape_divider_position="bottom" bg_image_animation="none"][vc_column column_padding="no-extra-padding" column_padding_position="all" background_color_opacity="1" background_hover_color_opacity="1" column_link_target="_self" column_shadow="none" column_border_radius="none" width="1/1" tablet_width_inherit="default" tablet_text_alignment="default" phone_text_alignment="default" overlay_strength="0.3" column_border_width="none" column_border_style="solid" bg_image_animation="none"][vc_column_text]

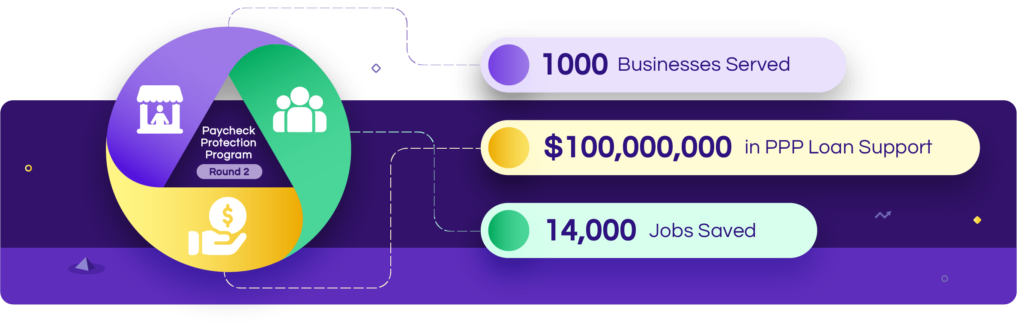

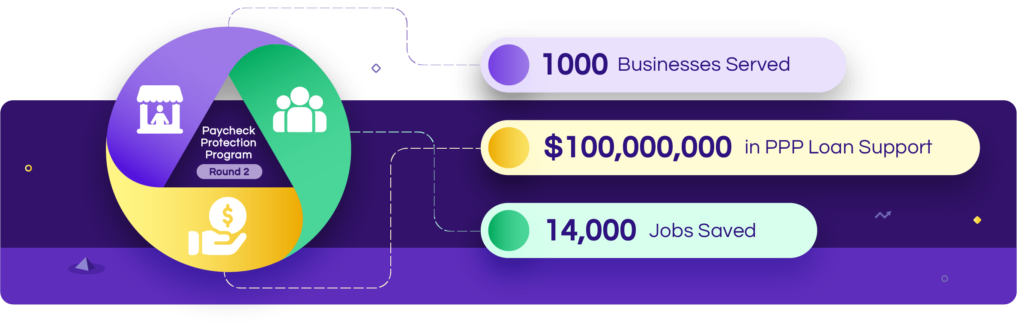

In late December 2020, Congress approved an additional COVID-19 relief package as part of the Consolidated Appropriations Act, 2021. Included in the $900 billion aid package is funding intended to provide a second round of relief for small businesses that are still struggling in the wake of the worldwide pandemic. A key piece of this legislation is funding earmarked for a second round of the Paycheck Protection Program, or, colloquially, PPP2.

The PPP Second Draw legislation is sure to be met with mixed feelings by small to mid-sized law firms across the country. Many of them are still weary from the first round of PPP; a poorly executed program that was full of uncertainties, constantly changing regulations, and a mixture of dread and uneasiness over the ramifications of improperly complying with rules that were released irregularly and without clear guidance. In fact, up until late December, one of the largest areas of concern – the tax treatment of the funds – left many law firms with cash-based, calendar-year financials with little time to plan or to react.

So now the question on law firm leaders’ minds is, understandably, “Should I even apply for PPP2?” Followed closely by, “If so, what’s in it for me?”

Here’s a quick rundown of what can be expected:

Here’s a quick rundown of what can be expected:

First Things First: Am I Eligible?

In order to be eligible to receive a Second Draw PPP loan, your firm must have experienced a revenue reduction of 25% or greater in 2020 relative to 2019.

This reduction can be calculated by comparing either one individual quarter from 2019 to the same quarter from 2020 or by comparing the calendar year 2019 to the calendar year 2020.

So, for example, if your gross revenue in the 2nd quarter of 2019 was $500,000 your gross revenue in the 2nd quarter of 2020 would need to be less than $375,000.

By giving firms the flexibility to compare one quarter versus another, even if you ended 2020 without a significant revenue reduction compared to 2019, you may still be eligible based on the performance of a single quarter.

Please also note that the maximum amount of any loan is $2 million and loans less than $150,000 will have easier paths to approval.

Next: What is the Same?

If you lived and breathed the first round of PPP Loans, many of the characteristics of the Second Draw PPP Loan will look very familiar to you:

Calculating Your Loan Amount

The formula for calculating the amount of your loan will be 2.5 times your average monthly costs. Average monthly payroll costs can be calculated using the 12 months prior to your loan for either the 2019 or 2020 calendar year. Payroll costs above $100,000 for any one employee (on a prorated, monthly basis) must still be excluded;

Substantiating Payroll Amounts

The documentation required to substantiate your firm’s payroll cost will generally be the same as what was required for your first PPP loan.

Maintaining Operations

Employee and compensation levels are maintained in the same manner as required for the First Draw PPP loan.

Forgiveness Terms

If your loan is not forgiven it will carry an interest rate of 1%, a maturity of 5 years, and payment deferrals.

Usage of Funds

At least 60% of the proceeds must be spent on qualifying payroll costs.

What has Changed?

While there have been a few changes there are a few unique terms of PPP2 which many law firms will find very favorable.

Covered Period Changes

Due to the top-heavy compensation models of most law firms many found themselves at a disadvantage when the 8-week covered period was first announced. Conversely, the 24-week covered period became administratively burdensome and left outstanding debt on the financials longer than many firms were comfortable with. However, the CAA now allows the borrower to select their own covered period as long as it is more than 8 weeks and less than 24 weeks from the loan origination date;

Eligible Expenditures

While PPP2 does still require borrowers to use at least 60% of the proceeds on payroll costs, the CAA has expanded the list of qualifying expenses that can result in forgiveness. In addition to items such as coverage for property damage, allowance of expenditures associated with costs outlaid for adapting your offices to meet enhanced safety standards or purchasing PPE for employees/clients/vendors, recipients can also include costs outlaid for “covered operations expenditures” to their forgiveness applications. This is defined as:

- A payment for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting or tracking of supplies, inventory, records and expenses;

- Further, the CAA does not delineate what time period that software payment may or may not cover. So, for example, it can be assumed that a one-time payment for a year of subscription-based business software would be eligible for forgiveness if it is made during the covered period.

Tax Treatment

Unlike the uncertainty that surrounds the tax treatment of the first round of PPP, the COVID-Related Tax Relief Act of 2020 (COVIDTRA- a piece of the CAA) has stipulated, from the onset, that funds received from the Second Draw PPP will not be taxable income to the recipient and that your firm can deduct expenses that are paid for with the loan’s proceeds. Finally, borrowers will not have to reduce tax attributes (such as the NOL carryover or a capital loss carryover) when the loan is forgiven.

Two more important items to note:

- Lender Selection: Even if you were unhappy with your bank’s initial rollout and administration of your first PPP loan, sticking with your original lender may mean you have less paperwork to submit thereby reducing your application time significantly and

- Deadline: The last day to apply for and receive a PPP loan is March 31, 2021.

So, while you may not be ready to tackle this “beast” again, it could provide very favorable funding options as you march your firm into 2021.

And we know this process can be daunting, so we have tried to make it a little easier for you to keep your firm organized. Download this prep-list and stay one step ahead!

[/vc_column_text][/vc_column][/vc_row]

Here’s a quick rundown of what can be expected:

Here’s a quick rundown of what can be expected: